Financial Planning for Post-Secondary Students: 8 Money Mistakes to Avoid

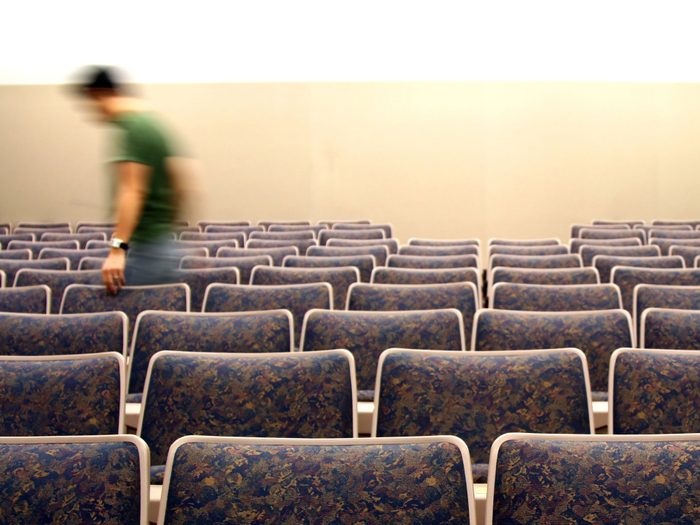

According to the Canadian Millennium Scholarship Foundation, only 54 per cent of university students and 58 per cent of college students graduate from their original program of study within five years. While these numbers don’t take into account students who switch programs and successfully complete them, they do underscore the fact that many students aren’t prepared for the rigours of post-secondary school-something I’ve witnessed first-hand as the Post-Secondary Student Adviser at the Toronto Film School.

We normally associate these rigours with academics, but a leading cause of dropping out-directly and indirectly-are financial struggles, which are often a result of poor money management.

Here are some tips and tricks to avoid the eight most common money mistakes I’ve seen post-secondary students make.

Money Mistake #1: Not budgeting lump sum finances

Without a budget in place, lump sum finances like savings accounts, student loans and scholarships can give students a false sense of security. This leads to excessive initial spending, and a bank account that’s fully depleted before the school term’s end. Not only can this lead to issues with paying for tuition and books in subsequent terms, but it can lead to dependence on credit cards, other loans, or an inability to pay for rent, food and utilities altogether.

Make use of the budget worksheet provided by the Financial Consumer Agency of Canada to help manage lump sums throughout the school year.

Money Mistake #2: Engaging in “retail therapy”

When students are stressed out, they’re less likely to make sound judgments-especially with their money. There’s also a higher chance they’ll convince themselves that wants are needs, and will spend their money accordingly. Making time to relax, tapping school resources for coping with academic pressures, and anticipating and overcoming the “retail therapy” response to stress are all important ways to ensure a healthy balance-both in life and in the bank account!

Money Mistake #3: Not factoring in the cost of food

Planning meals for the on-the-go student lifestyle can be challenging and time consuming. Campuses across the country are hard-wired for student convenience-vending machines, cafeterias and corner stores cater to the demand for quick and easy eats. While these instant meals may save time, planning meals ahead of time and preparing them with store-bought bulk ingredients presents a significant savings. Students also have the added resource of Canada’s Food Guide to help plan meals that aren’t just budget-friendly, but nutritious as well.

Money Mistake #4: Relying on credit cards

Students who are strapped for cash and stressed about school are more likely to spend recklessly. This risk is amplified when students assume that they flash the plastic and worry about the bill in the distant future. Not only can credit cards carry high fees, but interest charges can add up and will need to be factored into future budgets. Students should ensure they have enough budgeted funds to cover credit card expenses and limit credit card use to select large purchases.

Money Mistake #5: Not taking advantage of student discounts

Students all over Canada are offered special rates and discounts at countless retailers, restaurants and event venues-particularly when those businesses are located on or near a post-secondary school campus. All it usually takes to get these discounts is a valid student identification card. Student services departments or student unions often provide a full directory of discounts available to students, including those afforded by third party discount providers like ISIC and SPC. Students should always seek out these discounts when they’re shopping-especially when it involves necessities like personal care products, food and household supplies.

Money Mistake #6: Taking a leave from school without consulting the financial services department

Students who need to take time off school are often unaware of the financial consequences of doing so. These consequences vary from institution to institution, so it’s important for students to speak to a member of their school’s financial services department before making the decision. This is doubly important if the student is on government student loans, or if the decision is motivated by a dwindling bank account.

Money Mistake #7: Not keeping up with your studies

Failed classes can have lasting financial consequences. For one, unless the course is an elective, the exact same one will need to be taken-and paid for-again. There’s also the possibility of a snowball effect, in which a repeated class can cause scheduling havoc for subsequent terms. In the worst case scenario, this could result in a delayed graduation date, which means a prolonged period of part-time work while enrolled in school, and a delayed entrance into higher-paying full-time employment. If students are struggling in any of their classes, they should take advantage of school resources and services like tutoring, academic counselling and mentoring. Student services professionals are always ready, willing and able to assist!

Money Mistake #8: Being unrealistic about debt repayment

Whether loans come from the bank, the government, or family members, they need to be repaid within a certain time frame. The assumption that student loans will be easy and quick to repay is very common among post-secondary students-until graduation, that is. Realistically anticipating the monthly payments, the duration of those payments, and the effects those payments will have on future budgets is absolutely crucial. It can help create positive spending habits while students are in school and beyond.

If students are on a government student loan, they can use the Government of Canada’s CanLearn’s Loan Repayment Estimator to get an informed idea of what loan repayment schedule will look like. Similarly, banks can help prepare students for the repayment phase of their loans.

Calling all coupon clippers! We’re collecting the best budget-friendly flyers from neighbourhoods across Canada and sharing them on our website. Check out the weekly bargains in your own hometown!

Related features:

How to Save Money Like Milos Raonic

5 Best Business Tips from the Dragons’ Den Cast

13 Things Rich People Won’t Tell You